Nexus Mutual sluit zich aan bij 30+ DAO’s die Bancor’s DAO Treasury Management oplossing omarmen

Protocolrendement uniek beschermd door enkelzijdig uitzetten van Bancor

- Nexus Mutual DAO zal deze week de grootste treasury-storting op Bancor uitvoeren, en voegt zich bij tientallen DAO’s die onlangs protocol-treasury op Bancor hebben ingezet.

- Bancor komt naar voren als de favoriete DAO Treasury Management-oplossing voor DAO’s die gedecentraliseerde on-chain liquiditeit willen opbouwen in hun eigen token.

- Met het geautomatiseerde Single-Sided Staking-systeem van het protocol kunnen DAO’s liquiditeit bieden en passief inkomen verdienen in hun oorspronkelijke token, volledig beschermd tegen het risico van tijdelijk verlies.

- Bancor is de grootste bron van gedecentraliseerde liquiditeit geworden voor grote tokens zoals LINK, SNX, BAT, ENJ, AMP, wNXM en meer.

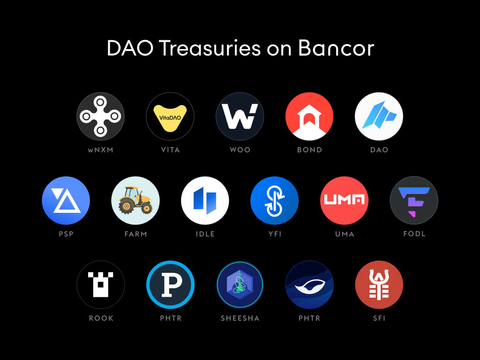

- Toonaangevende DAO’s hebben onlangs schatkistfondsen gestort op Bancor, waaronder UMA, Paraswap, KeeperDAO, WOO Network DAO en BarnBridge.

- 30+ DAO’s zijn van plan hun schatkist in te zetten en beloningen te bieden op “Bancor 3”, de aankomende nieuwe versie van het protocol.

ZUG, Zwitserland–(BUSINESS WIRE)– Nexus Mutual zal deze week de grootste DAO-treasury-deposito op Bancor uitvoeren, en voegt zich bij tientallen DAO’s die onlangs schatkistfondsen op Bancor hebben ingezet.

Dit persbericht bevat multimedia. Bekijk de volledige release hier: https://www.businesswire.com/news/home/20220303005706/en/

Nexus Mutual Joins 30+ DAOs Adopting Bancor’s DAO Treasury Management Solution

Protocol Yield Uniquely Protected by Bancor Single-Sided Staking

- Nexus Mutual DAO will execute the single largest treasury deposit on Bancor this week, joining dozens of DAOs that have recently staked protocol treasury on Bancor.

- Bancor is emerging as the preferred DAO Treasury Management solution for DAOs seeking to build decentralized on-chain liquidity in their native token.

- The protocol’s automated Single-Sided Staking system lets DAOs provide liquidity and earn passive income in their native token fully protected from the risk of Impermanent Loss.

- Bancor has become the largest source of decentralized liquidity for major tokens like LINK, SNX, BAT, ENJ, AMP, wNXM & more.

- Leading DAOs have recently deposited treasury funds on Bancor including UMA, Paraswap, KeeperDAO, WOO Network DAO & BarnBridge.

- 30+ DAOs plan to stake their treasuries and offer rewards on “Bancor 3”, the protocol’s upcoming new version.

ZUG, Switzerland–(BUSINESS WIRE)– Nexus Mutual will execute the single largest DAO treasury deposit on Bancor this week, joining dozens of DAOs that have recently staked treasury funds on Bancor.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220303005706/en/

(Graphic: Business Wire)

The deposit of over $2.2m wNXM comes as a growing number of top DAOs and token projects are allocating funds on Bancor, including UMA, Flexa Network (AMP), Paraswap (PSP), KeeperDAO (ROOK), Harvest Finance (FARM), Request Network (REQ), Instadapp (INST), WOO Network DAO (WOO) & more.

Bancor is emerging as the preferred DAO Treasury Management solution to generate Protocol-Owned Liquidity that is protected from Impermanent Loss. Depositors on Bancor earned over $200m in 2021, using the protocol to provide single-sided liquidity and earn passive income on over 100 integrated tokens with 100% protection from Impermanent Loss.

Bancor has become the largest source of decentralized liquidity for major tokens, accounting for 60-80% of Ethereum on-chain liquidity in tokens like LINK, SNX, BAT, ENJ, AMP, wNXM & more. Average annual yields on Bancor have ranged from 5-60% in recent months. Meanwhile, more than 30 token projects plan to provide liquidity and incentivize pools on “Bancor 3”, the protocol’s upcoming new version.

Nexus Mutual founder, Hugh Karp, said: “Bancor doesn’t require any maintenance, is battle-tested and will ultimately drive higher income to our DAO and community due to there being no Impermanent Loss. We’re able to fund our pool with wNXM-only liquidity and attract loyal token holders as long-term liquidity providers without needing to sell tokens or issue incentives.”

Nate Hindman, Contributor at Bancor, said: “We are very excited to have Nexus Mutual join the growing list of projects building sustainable decentralized liquidity for their tokens on Bancor. Both Nexus and Bancor are focused on designing decentralized solutions for risk-averse users seeking safe and reliable access to DeFi.”

DAOs stake funds on Bancor to:

- Build sustainable on-chain liquidity in their native token

- Earn safe and reliable passive income without exposing treasury funds to the risk of Impermanent Loss

- Expand token holder access to liquidity provision, creating more decentralized and robust liquidity

- Coming soon in Bancor 3: Deploy auto-compounding rewards that deepen token liquidity from day one

Learn about:

About Bancor

Bancor is the first decentralized staking protocol that lets liquidity providers earn trading fees with single-token exposure and full protection from impermanent loss. In 2017, Bancor invented the first automated market-makers (AMMs) on Ethereum. Today, it generates millions in earnings per month for depositors, offering up to 60% APR on tokens like ETH, WBTC, LINK, MATIC, SNX & more.

About Nexus Mutual

Nexus Mutual is a decentralized discretionary mutual where members come together to share risk. The protocol’s 8000+ members earn crypto yields in a much safer way by protecting them against new and evolving risks in DeFi such as technical failures, oracles attacks and hacks.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220303005706/en/

Contacts

Nate Hindman