Ekata lanceert Merchant Onboarding-oplossing om snellere, slimmere beoordelingen van Merchantrisico’s mogelijk te maken

Nieuwe API- en SaaS-oplossingen koppelen bedrijven aan de individuen erachter, waardoor betalingsproviders en geldschieters sneller dan ooit tevoren en met meer vertrouwen aan boord kunnen gaan

SEATTLE– (BUSINESS WIRE) – Ekata, de leider in wereldwijde digitale identiteitsgegevens, heeft vandaag zijn Merchant Onboarding-oplossing aangekondigd om payment service providers (PSP’s), B2B-geldschieters en marktplaatsen te helpen bij het groeiende aantal micro-handelaars en eenmanszaken over de hele wereld sneller en met meer vertrouwen. Het gebrek aan commerciële staat van dienst voor deze nieuwe kleine bedrijven maakt het moeilijk voor betalingsdienstaanbieders en kredietverstrekkers om ze snel en vol vertrouwen goed te keuren met behulp van traditionele methoden voor risicobeoordeling. Ekata wilde klanten helpen hun bestaande modellen te verbeteren met risico-indicatoren die de waarschijnlijkheid van fraude aantonen op basis van een mix van uitgebreide klantdatatests en overwegingen van best practices. Door unieke gegevens te leveren die de verbinding tussen bedrijven en de personen achter hen kruisen, stelt Ekata’s nieuwe onboarding-oplossing voor verkopers organisaties in staat om met vertrouwen risico’s op grote schaal te beoordelen, onboarding-workflows te automatiseren en de tijd die wordt besteed aan handmatige beoordeling te verminderen.

Dit persbericht bevat multimedia. Bekijk de volledige release hier: https://www.businesswire.com/news/home/20210407005320/en/

Ekata Launches Merchant Onboarding Solution to Enable Faster, Smarter Assessments of Merchant Risk

New API and SaaS solutions link businesses to the individuals behind them, enabling payment providers and lenders to onboard merchants faster than ever before and with higher confidence

SEATTLE–(BUSINESS WIRE)– Ekata, the leader in global digital identity data, today announced its Merchant Onboarding solution to help payment service providers (PSPs), B2B lenders and marketplaces onboard the growing number of micro-merchants and sole proprietors across the globe faster and with more confidence. The lack of commercial track record for these new small businesses makes it difficult for PSPs and lenders to quickly and confidently approve them using traditional methods of risk assessment. Ekata set out to help customers enhance their existing models with risk indicators that show fraud likelihood based on a mix of comprehensive customer data tests and best-practice considerations. By providing unique data that cross-checks the connection between businesses and the individuals behind them, Ekata’s new merchant onboarding solution enables organizations to confidently assess risk at scale, automate onboarding workflows, and reduce time spent in manual review.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210407005320/en/

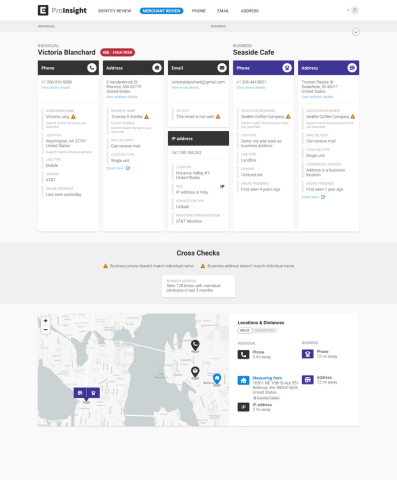

Ekata’s Merchant Review solution visually surfaces unique, cross-linked individual and business data to help review agents and underwriting teams make quicker, more confident onboarding decisions. (Graphic: Business Wire)

The global pandemic accelerated an existing trend of individuals establishing their own small businesses. In the U.S. alone there are 30 million small merchants and an additional 40 million individuals who became independent contractors in 2020. Similarly, Europe has 25.1 million small businesses and a growing 33 million sole proprietors. On the tailwinds of this trend, Covid-19 added some additional unexpected fuel: in October 2020, the U.S. Census Bureau published the business-formation statistics for the third quarter of 2020. Third-quarter 2020 business applications rose by 77.4% from June to September.

With this massive growth comes an increasing demand for quick and effective onboarding of these merchants by PSPs and lending institutions. Companies like Stripe, Square, PayPal and others have set a new standard by cutting onboarding times from 2-3 days to just minutes, often threatening the business viability of other PSPs whose processes and risk assessments can’t keep up with their pace. In this intensely competitive market, Ekata’s solution helps PSPs and lenders respond to the increasing expectations for speedier onboarding.

“Merchants today have plenty of options and will quickly turn to another payment service provider if an organization adds too much friction at onboarding or takes too long on approvals,” says Beth Shulkin, Ekata’s VP of Global Marketing. “This is much more than a customer experience issue for PSPs and lenders; losing the lifetime value of a merchant has real bottom-line impact.”

Ekata’s holistic solution is designed to solve both sides of the flow: automating the onboarding process via APIs and enabling more efficient manual reviews with a SaaS solution. Our API integrates easily with existing rules or machine learning-based risk models, and our SaaS product quickly surfaces correlations between key individual and business identity attributes on easy-to-read dashboards.

Key benefits of the Merchant Onboarding solution include:

- Onboard micro-merchants and sole proprietor businesses with higher confidence: With individual, business, and unique cross-linked signals, Ekata customers can build trusted risk profiles for micro-merchants and sole proprietors that lack the typical track record – verifying information and approving or rejecting applications with confidence.

- Quickly route good customers for automated underwriting: Businesses can shift low-risk merchant applications away from high friction onboarding steps such as supplemental document collection and manual review, towards automated approval, which gets these customers onboard and generating revenue as quickly as possible. They can then focus on high-risk customers that need additional documentation or manual review.

- Reduce time spent in manual review: Businesses can quickly view a key set of individual and business data, reducing the time needed to research data across multiple sources and helping the reviewer make a faster, more efficient, and more accurate decision.

For additional information on Ekata’s Merchant Onboarding API, visit here. To learn more about Ekata’s Merchant Review, visit here.

About Ekata

Ekata provides global identity verification via APIs and a SaaS solution to provide businesses worldwide the ability to link any digital transaction to the human behind it. The Ekata product suite is powered by the Ekata Identity Engine, our proprietary, intellectual property, that uses unique datasets from the Ekata Identity Graph and the Ekata Identity Network that provides identity verification data with consistent results across the globe, in industry-leading response times, to enable businesses around the world like AliPay, Microsoft, Stripe, and Airbnb to fight fraud, reduce false declines, and make accurate risk decisions about their customers faster than the blink of an eye.

Ekata is a trademark of Ekata, Inc. All other trade names, trademarks and registered trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210407005320/en/

Contacts

Danielle Capers

Voxus PR

253-225-5178