Crystal Blockchain: peer-to-peer-uitwisselingen hebben regelgeving nodig om het witwasrisico te verminderen

AMSTERDAM– (BUSINESS WIRE) – Op de V20-top in november 2020 kondigde de Financial Action Task Force (FATF) aan dat regelgevende vereisten voor peer-to-peer (P2P) uitwisselingen – in de trant van die voor Virtual Asset Service Providers (VASP’s) – zal waarschijnlijk in 2021 verschijnen om het money laundering (ML) te bestrijden. De FATF verzamelt nu gegevens over deze uitwisselingen om ervoor te zorgen dat hun richtlijnen P2P’s weerspiegelen.

Dit persbericht bevat multimedia. Bekijk de volledige release hier: https://www.businesswire.com/news/home/20210203005351/en/

Het Crystal team heeft een YoY-analyse gemaakt van P2P-transactieactiviteit om te zien of de intenties van de FATF om strengere regels in te voeren, van invloed zijn geweest op de hoeveelheid bitcoin die via deze gedecentraliseerde uitwisselingen van januari 2019 tot december 2020 wordt overgedragen.

Crystal Blockchain: Peer-to-Peer Exchanges Need Regulation to Lower Money Laundering Risk

AMSTERDAM–(BUSINESS WIRE)– At the V20 Summit in November 2020, the Financial Action Task Force (FATF) announced that regulatory requirements for peer-to-peer (P2P) exchanges – along the lines of those for Virtual Asset Service Providers (VASPs) – will likely emerge in 2021 to combat money laundering (ML). The FATF is now collecting data on these exchanges to allow their guidelines to reflect P2Ps.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210203005351/en/

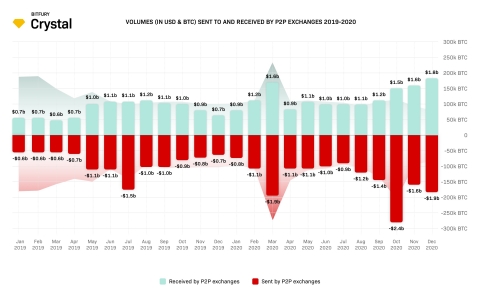

Volumes (in BTC and USD) sent to and received by P2P Exchanges 2019-2020 (Graphic: Business Wire)

The Crystal team did a YoY analysis of P2P transaction activity to see whether the FATF’s intentions to bring tighter regulations has affected the amount of bitcoin transferred via these decentralized exchanges from January 2019 to December 2020.

Key Findings:

- Sent and received amounts (in US dollar) by P2P exchanges in December 2020 increased by +164% and +197% compared to January 2019.

- Received and sent amounts (in bitcoin) in December 2020 decreased by -55% and -50%, compared with January 2019.

- The main reason for the disparity is that while the price of bitcoin has grown 6X between January 2019 and December 2020, the popularity of P2P exchanges has declined.

- The amounts sent and received in bitcoin by P2P exchanges rapidly dropped in November and December 2020, and this is most likely due to the November 2020 FATF announcement of future regulation of P2P.

- The amounts of received bitcoin by Non-P2P exchanges have had a growing trend in comparison to P2P exchanges, explained by higher popularity and a better “reputation”.

P2P exchanges may be less popular than Non-P2P thus far for a few reasons:

- less regulatory oversight from the FATF,

- more complicated operational principles,

- they might be considered potential ML platforms due to a lack of intermediaries.

That being said, innovation and developments in the P2P sector continue to rise, and as regulatory requirements increase, P2P will become a safer and more transparent space.

Compliance software for P2P transactions is being developed, and the P2P exchange sector will increase in popularity when it’s possible to further manage AML and compliance risk.

Visit the Crystal website to see the full Report on P2P Transaction Volumes 2019-2020.

About Crystal Blockchain:

Crystal is the all-in-one blockchain analytics tool for crypto AML compliance. Available as a free demo version, SaaS, API, and for on-premise installation. Engineered by the Bitfury Group.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210203005351/en/

Contacts

Oleh Rozvadovskyy

+38-050-377-04-87